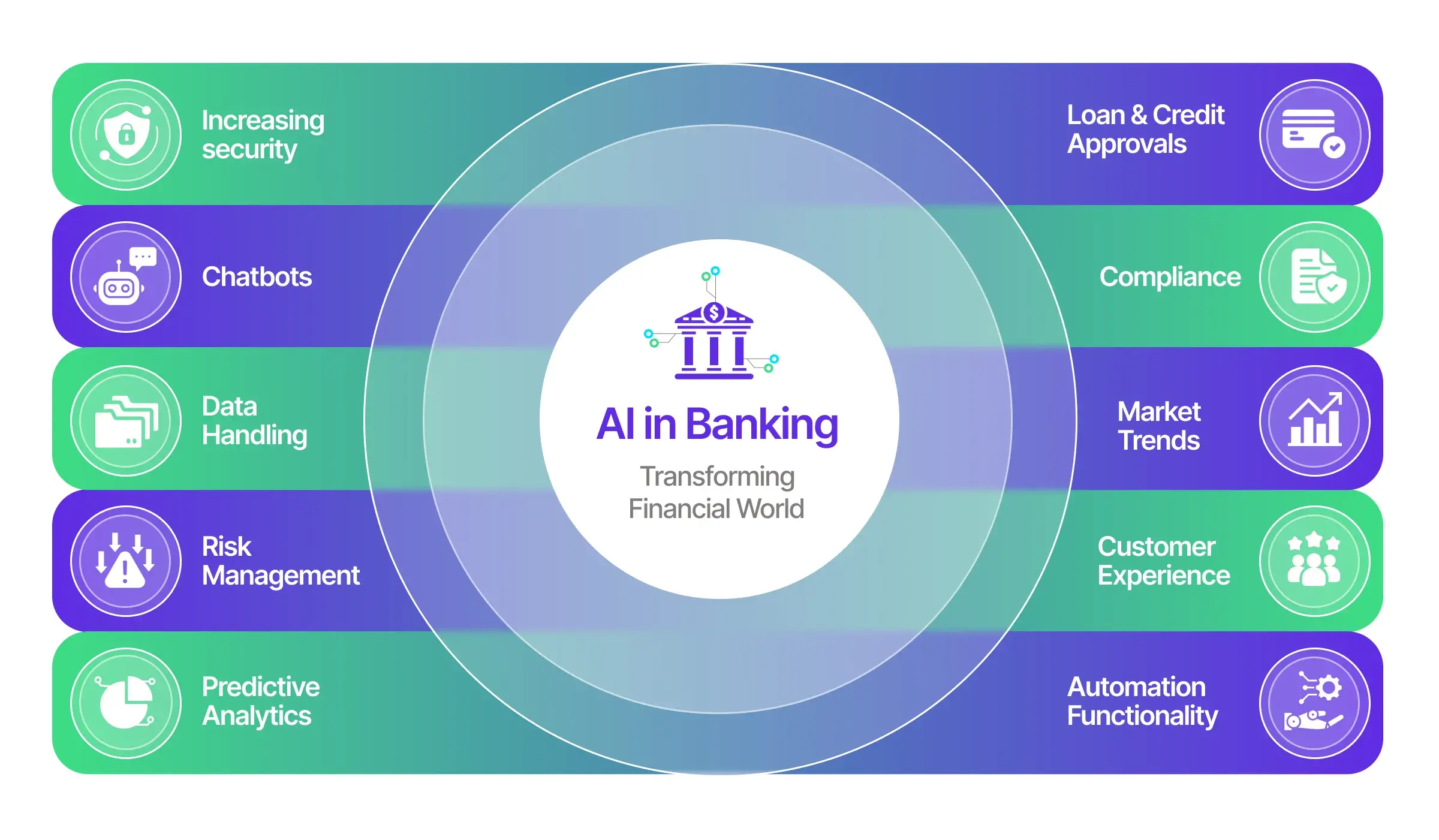

The banking industry has always been at the forefront of technological advancements. In recent years, Artificial Intelligence (AI) has emerged as a game-changer, transforming traditional banking operations and customer experiences. AI-powered innovations are making banking more efficient, secure, and customer-centric, paving the way for a smarter financial ecosystem.

As we move further into 2025, AI continues to revolutionize the banking sector in multiple ways. In this blog, we will explore the key impacts of AI on the banking industry, its benefits, challenges, and the future of AI-driven banking.

1. AI-Powered Chatbots and Virtual Assistants

One of the most significant applications of AI in banking is the use of chatbots and virtual assistants. These AI-driven tools enhance customer service by providing instant responses, personalized recommendations, and 24/7 support.

How AI Chatbots Are Transforming Banking:

- Instant query resolution for customers without human intervention.

- Personalized financial advice based on user spending habits.

- AI-driven chatbots like Bank of America’s Erica and HDFC Bank’s EVA are improving user experience.

- Reduced operational costs by automating customer support tasks.

2. AI for Fraud Detection and Cybersecurity

With the rise of digital banking, cybersecurity threats have also increased. AI-powered fraud detection systems analyze vast amounts of data to identify suspicious transactions and prevent financial fraud.

How AI Enhances Fraud Prevention:

- Real-time monitoring of transactions to detect anomalies.

- AI algorithms assess behavioral patterns to identify potential fraud.

- Automated blocking of suspicious transactions to enhance security.

- Reduction in false positives, ensuring a seamless user experience.

3. Personalized Banking and Customer Insights

AI helps banks understand their customers better by analyzing transaction history, spending habits, and financial goals. This leads to highly personalized banking experiences and better financial recommendations.

Benefits of AI-Powered Personalization:

- AI-driven financial planning and budgeting tools.

- Predictive analytics to suggest investment opportunities.

- Personalized credit offers and loan recommendations.

- Enhanced customer satisfaction and engagement.

4. AI in Loan and Credit Risk Assessment

Traditional loan approval processes can be time-consuming and error-prone. AI has transformed credit risk assessment by using machine learning algorithms to evaluate a borrower’s financial history and predict their creditworthiness accurately.

How AI is Improving Loan Approvals:

- Faster processing of loan applications with automated analysis.

- AI-based scoring models for better risk assessment.

- Inclusion of alternative credit data, such as social behavior and digital footprint.

- Reduced loan default rates by identifying high-risk applicants.

5. Automation in Back-End Banking Operations

AI is streamlining back-end banking operations, reducing human errors, and increasing efficiency. From document processing to regulatory compliance, AI automates complex workflows, saving time and resources.

Applications of AI in Banking Operations:

- Optical Character Recognition (OCR) for document verification.

- AI-powered automation in KYC (Know Your Customer) processes.

- Streamlined regulatory compliance to prevent legal issues.

- Cost reduction through AI-driven operational efficiency.

6. AI-Powered Trading and Investment Management

AI is playing a crucial role in the stock market and investment sector. AI-driven trading bots analyze market trends, predict stock performance, and execute trades in real time, enhancing portfolio management.

How AI is Impacting Investment Management:

- Algorithmic trading for faster and more accurate trade execution.

- Robo-advisors providing low-cost, AI-driven investment advice.

- AI-based risk assessment and portfolio optimization.

- Data-driven insights for better investment decisions.

7. Voice Banking and AI-Powered Voice Recognition

Voice recognition technology is making banking more convenient. AI-powered voice banking allows users to perform transactions, check balances, and get account information using voice commands.

Advantages of Voice-Enabled Banking:

- Hands-free banking experience through smart assistants.

- Enhanced security with voice biometrics authentication.

- Increased accessibility for visually impaired users.

- Faster and more intuitive banking interactions.

8. Predictive Analytics for Financial Forecasting

Banks use AI-powered predictive analytics to forecast market trends, customer needs, and economic fluctuations. This helps banks make data-driven decisions and stay ahead of financial challenges.

How Predictive Analytics Benefits Banks:

- Forecasting customer demand for financial products.

- Identifying potential economic downturns and preparing accordingly.

- Improving asset and liability management.

- Enhancing decision-making with AI-driven insights.

Challenges and Ethical Concerns of AI in Banking

While AI offers numerous benefits, it also presents certain challenges and ethical concerns:

- Data Privacy Issues: Handling vast amounts of sensitive customer data raises security concerns.

- Bias in AI Algorithms: AI models can be biased if trained on unbalanced datasets.

- Regulatory Compliance: Banks must ensure AI-driven decisions comply with financial regulations.

- Job Displacement: Increased automation may lead to reduced human workforce in banking.

The Future of AI in Banking

The future of AI in banking looks promising, with continuous advancements in technology. Here are some trends we can expect:

- Increased adoption of blockchain-powered AI for secure transactions.

- AI-driven financial wellness platforms offering proactive advice.

- Greater integration of AI in decentralized finance (DeFi) solutions.

- Expansion of AI-powered biometric authentication for enhanced security.

Final Thoughts

AI is redefining the banking industry by making financial services more efficient, secure, and personalized. From fraud detection to customer service and investment management, AI is streamlining operations and improving user experiences. However, to maximize the benefits, banks must address ethical concerns and ensure AI is used responsibly.

As we move into the future, AI-driven banking will continue to evolve, bringing new opportunities and challenges. Businesses and consumers alike must stay informed and adapt to these changes to make the most of AI’s transformative power in finance.